Still have questions? Fill out the form below

Frequently asked questions

START HERE

What are your fees and your minimums?

Clients must invest a minimum of $500,000, which can be separated into multiple accounts of at least $250,000 each.

Why do you manage each client account separately?

Unlike mutual funds, hedge funds, or ETFs, we craft individual portfolios for each client. This means that:

1. As a new client, you won’t be forced to invest in unsafe stocks just because other clients hold them. We’ll invest your account only into stocks that still have a significant safety margin. Learn more about our investment process here.

2. Your unique circumstances and wishes will be accommodated. Some of our clients ask to avoid tobacco or defense stocks. Others want to take capital gains or losses for tax reasons. We make those adjustments happen.

3. You’ll own your cost basis, so you won’t have to pay taxes on gains enjoyed by previous investors (as often happens in mutual funds).

This is just part of IMA’s exceptional client experience. Learn more.

Is IMA right for me?

We’re not everyone’s cup of tea. But we are the firm you need if you’re looking for:

- Low-risk value investing oriented towards long-term growth

- Research-based, fad-free stock selection

- Full transparency about what your portfolio contains and why

- Custom-tailored portfolio and client experience

- Direct line of communication with decision makers

- No conflicts of interest

- Managers who own the same stocks as you

START HERE

What are your fees

and your minimums?

Clients must invest a minimum of $500,000, which can be separated into multiple accounts of at least $100,000 each.

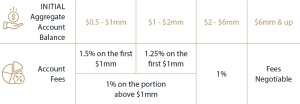

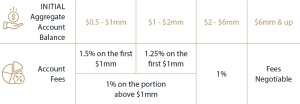

Initial Aggregate Account Balance: $0.5 – $1mm

- 1.5% on the first $1mm

- 1% on the portion above $1mm

Initial Aggregate Account Balance: $1 – $2mm

- 1.25% on the first $1mm

- 1% on the portion above $1mm

Initial Aggregate Account Balance: $2 – $6mm

- 1%

Initial Aggregate Account Balance: $6mm & up

- Fees Negotiable

Why do you manage

each client account

separately?

Unlike mutual funds, hedge funds, or ETFs, we craft individual portfolios for each client. This means that:

1. As a new client, you won’t be forced to invest in unsafe stocks just because other clients hold them. We’ll invest your account only into stocks that still have a significant safety margin. Learn more about our investment process here.

2. Your unique circumstances and wishes will be accommodated. Some of our clients ask to avoid tobacco or defense stocks. Others want to take capital gains or losses for tax reasons. We make those adjustments happen.

3. You’ll own your cost basis, so you won’t have to pay taxes on gains enjoyed by previous investors (as often happens in mutual funds).

This is just part of IMA’s exceptional client experience. Learn more.

Is IMA right for me?

We’re not everyone’s cup of tea. But we are the firm you need if you’re looking for:

- Low-risk value investing oriented towards long-term growth

- Research-based, fad-free stock selection

- Full transparency about what your portfolio contains and why

- Custom-tailored portfolio and client experience

- Direct line of communication with decision makers

- No conflicts of interest

- Managers who own the same stocks as you

What types of accounts do you manage?

We help clients with a wide range of investment accounts, from different types of IRAs to various taxable accounts. Here is the full laundry list:

Retirement accounts:

IRA / IRA rollover / Roth IRA / SEP IRA / simple IRA

401(k) – we do not administer 401(k), just manage investments

Taxable Accounts:

Individual / joint / community / transfer on death / tenants by the entirety / conservatorship / custodial / estate / joint tenants with rights of survivorship / community property / guardianship / tenants in common / community property with rights of survivorship

Trusts:

revocable / irrevocable / testamentary trust created by will or probate

Organizations (incorporated or nonincorporated; partnerships, pooled investment accounts, foundations)

How many positions do you have in your portfolios?

When choosing how many companies we should hold in our portfolios we strive to strike a balance between two extremes: over- and under-diversification. We own few enough stocks such that every one of them matters, but not so few that we can’t afford to be wrong on a few of them.

This typically translates to 20 to 30 stocks, with position sizes fluctuating between 2% to 6%. Most positions are in the 4-6% range (at cost).

Looking for a more detailed answer? We cover this topic in more depth in our full-detail brochure. Download it here.

What are your sell criteria?

We sell a stock for one of 3 reasons:

1. It reached its full potential.

2. We found a stock with better risk-adjusted returns.

3. Something has gone wrong with the company.

You can find more detail about our sell criteria on our investment process page, or in our full-detail brochure.

Do you time markets?

It is hard, if not impossible, to create a successful market-timing process. A market timer’s buy and sell decisions are made based on predicting the short-term direction of stock prices, interest rates, or the condition of the economy. This demands that you be correct twice – when you buy and when you sell – and market timing puts emotions in the driver’s seat, especially at market tops and bottoms.

Instead of trying to time the market, we value individual stocks (call it timing if you like). As simplistic as it sounds, we buy stocks when they are undervalued and sell them when they are fairly valued.

As a market timer your cash balance is a function of what you think the market is about to do. Our cash balance is a by-product of investment opportunities we see in the market. If we cannot find enough stocks that meet our strict criteria, we’ll hold more cash.

Learn more about our investment process here and our investing principles here.

What does your turnover look like?

Despite active being in the name of our strategy, we are not traders; we are investors. The word active amplifies the importance of our sell discipline. We are not buy-and-hold investors; we are buy-and-sell investors. Just because we’ve bought a stock doesn’t mean we’ll hold it forever – it has to deserve to stay in the portfolio. It still has to continue offering a compelling risk-adjusted return for us to go on holding it. It is hard to precisely measure the turnover of our portfolio, but we guestimate it to be around 30% a year.

We have owned many companies for longer than five years, and some we owned for less than a year (though this happens less often). When we analyze companies we look at them not as pieces of paper but as businesses we intend to own for a long period of time.

Why do you love market volatility?

Conventional wisdom views volatility as risk. We don’t. We befriend it, embrace it, and try to take advantage of it. The true risk is not volatility but permanent loss of capital. For someone who has not researched a company, it is not readily apparent whether a decline in shares is temporary or permanent. After all, if you don’t know what the company is worth, the quoted price becomes the measure of intrinsic value.

If you know what the company is worth, then change in intrinsic value is all that is going to matter. The price quoted on the exchange will be your friend, allowing you to take advantage of the difference between intrinsic value and the quoted stock price. If the quoted price is significantly cheaper than your estimated intrinsic value, you buy the stock or buy more of it if you already own it. If the opposite is true, you sell it.

You can learn more about how we value stocks on our investment process page or, in more detail, in our full-detail brochure.

How much time do you spend on macro forecasting?

Usually, macro forecasting is frowned upon in the value investing community, and Warren Buffett has everything to do with that. He is famous for saying, “My decision making would not change even if I knew what the Federal Reserve will do with interest rates next month.” There is sound logic behind this: Forecasting the economy is incredibly difficult in the short run.

As an investor you want to spend very little time on forecasting the weather (that is, what the Fed will do with interest rates next month or the rate of growth of the economy). Weather forecasting, first of all, is not always accurate, but it will certainly consume a lot of time and energy, and the forecasts have a very finite shelf life. Yesterday’s weather is irrelevant today. As long as you own companies that can survive rain — even a few weeks of rain — without catching pneumonia, weather forecasting is a waste of time. This is what Buffett was implying by saying he didn’t want to be a macro forecaster.

Instead of being a weatherman, we pay serious attention to “climate change” — significant shifts in the global economy that can impact your portfolio.

Learn more about our investment process and investing principles.

Why do you build models?

Models help us to understand the economics of the business we’re considering investing in.

We usually build two type of models: a very detailed, in-depth model that zeros in on different aspects of the business and a much simpler and smaller model that focuses only on the essentials of the business.

It is easier to build the detailed model model than the simple one. If we can build a simple model, that means we understand the drivers of the business – we understand what matters.

Models are important because they help us remain rational. It is only a matter of time before a stock we own will decline. When it does, our models help us determine whether this decline is important in the long run.

To learn more about how and why we build models, click here.

How many people make the investment decisions at your firm?

All investment decisions at IMA are made by Michael Conn and Vitaliy Katsenelson. Vitaliy is the lead manager of all investment strategies.

This strategy is strengthened by insights from a global network of five dozen investors with whom we share research: They provide feedback and are a great source of new investment ideas.

Read more about our team here.

What sort of style box do you fit into? Large vs. small-cap, growth vs. value?

We don’t voluntarily lock ourselves into any box. We are looking to own great businesses at ridiculously low prices. They can be of any size (as long as they are liquid); we’ll look for them in any country (that operates by the rule of law); and they can be “growth” or “value” as long as they are cheap.

Learn more about our investing principles here.

What percentage of your portfolio is domestic/international?

This will vary depending on the opportunities we see at any point in the US and foreign countries. Currently about two-thirds of the portfolio is in the US and one-third is outside. But we can see the ratio shifting toward fifty-fifty.

To learn more about our stock selection, see our investment process and investing principles.

How often do you review positions in your portfolio?

We revisit each company at least quarterly as we listen to the company’s conference calls, read its quarterly reports, and update our models. But it’s really a continuous process. We read the news flow and think constantly about the stocks we own.

Read more about how we analyze companies here.

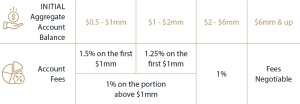

What are your fees and minimum investment limit?

Initial Aggregate Account Balance: $0.5 – $1mm

- 1.5% on the first $1mm

- 1% on the portion above $1mm

Initial Aggregate Account Balance: $1 – $2mm

- 1.25% on the first $1mm

- 1% on the portion above $1mm

Initial Aggregate Account Balance: $2 – $6mm

- 1%

Initial Aggregate Account Balance: $6mm & up

- Fees Negotiable

How do I know that my assets are secure with you?

We don’t custody your assets; they are in accounts under your name with Charles Schwab or Fidelity. You have access to those accounts as if we were not involved. Our agreement gives us only a limited power of attorney to enter buy and sell orders. We cannot disburse funds.

How do I start investing with IMA?

See the relevant page here.

What will happen if IMA assets continues to grow?

Growth presents several challenges: Larger AUM will reduce our ability to purchase smaller companies, and having more clients will mean we must hire more folks in operations. The IMA team and I have been thinking about this issue for a while.

Here is what we have come up with:

Currently, AVI invests across companies of all sizes, including small-cap stocks. If we find that our AUM size limits us from buying small companies, we will close the current version of our Active Value Investing (AVI) strategy to new clients.

Over the last five years, we have invested a lot of time and resources into our systems. We can increase the number of accounts we manage by 10x without stressing those systems. However, we want to make sure that we continue to provide great customer service. We cannot grow the number of client relationships and still provide that service without hiring more people in operations. Therefore, our operations team may scale in the future to continue providing great customer service.

Does a larger firm put constraints on my (Vitaliy’s) time?

Not really. I spend almost no time talking to prospects and very little time talking to clients – although I am a phone call away if you need to talk to me. I have been working very hard to remove the need to call me by writing detailed and hopefully engaging seasonal letters. I truly hope they answer most of your questions. I can leverage my writing, but I can’t do the same with one-on-one conversations. I enjoy meeting clients when I travel, so we will continue to host local client dinners. We have received great feedback on those meetings. Additionally, our annual client dinner, is another opportunity for us to meet clients.

Ironically, the larger IMA gets, the less time I spend running it. I am turning delegation into an art form. I am also blessed to work with a terrific team. I love doing research, and I enjoy writing. I have found that I cannot write more than two hours a day – this is why I write from 5–7am every day. If I keep doing what I am doing, I will continue on my journey of never working a day in my life.

Where can I find IMA's regulatory filings and other documents?

READY TO INVEST? HAVE MORE QUESTIONS?

Fill out the form below to get started and we’ll get back

to you the next business day or Call us at 303-796-8333